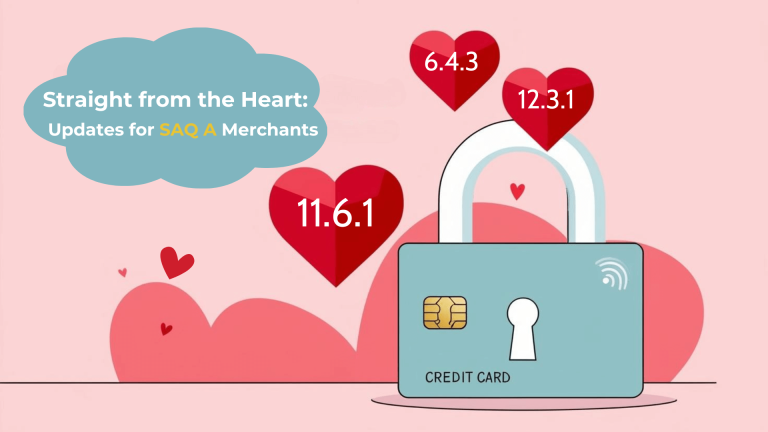

The New PCI DSS Standards for Safer Payment Pages

The Payment Card Industry Data Security Standard (PCI DSS) is stepping up its requirements to address a significant, often overlooked vulnerability—third-party scripts. Beginning in March 2025, requirements 6.4.3 and 11.6.1 will require organizations to inventory, monitor, and secure third-party scripts embedded on payment pages. These changes reflect a proactive approach to safeguarding sensitive payment data from modern threats.

Why Third-Party Scripts Are a Security Blind Spot

Third-party scripts are the hidden workhorses of e-commerce, enabling payment processing, customer engagement, and analytics. However, these scripts also create significant risks:

- Unauthorized Changes: Providers can push updates without notice, potentially introducing vulnerabilities.

- Supply Chain Attacks: Hackers target third-party providers to inject malicious scripts.

- Compliance Challenges: Without oversight, organizations risk falling out of compliance with PCI DSS standards.

PCI DSS’s updated requirements aim to bring these “shadows” into the light with clear inventory, control, and monitoring protocols.

Dissecting Requirements 6.4.3 and 11.6.1

The new rules focus on securing and maintaining visibility over third-party scripts:

- Requirement 6.4.3:

- Create and maintain a detailed inventory of all third-party scripts on payment pages.

- Each script must have a documented business or technical justification.

- Implement controls to prevent unauthorized script additions or updates.

- Applies to merchants embedding third-party payment forms or pages.

- Requirement 11.6.1:

- Deploy real-time monitoring tools to detect unauthorized changes to script content or HTTP headers on payment pages.

- Monitoring must occur weekly at a minimum, with actionable alerts for unauthorized changes.

What Attacks Do These Requirements Prevent?

The focus on third-party scripts addresses several prominent cyberattack methods:

- Magecart Attacks:

- Attackers inject malicious scripts into payment pages to steal credit card details during transactions.

- Inventory and real-time monitoring prevent tampered scripts from going unnoticed.

- Script Injection:

- Malicious actors alter scripts to redirect users to fake payment pages or embed harmful code.

- Content Security Policies (CSP) and integrity checks block unauthorized execution.

- Supply Chain Compromises:

- Cybercriminals compromise third-party script vendors, spreading malicious code across all their customers.

- Collaboration with vendors and real-time monitoring mitigate these risks.

- Man-in-the-Middle Exploits:

- Adversaries intercept and alter HTTP headers or script data, compromising customer information.

- Weekly monitoring ensures quick detection of tampering.

Steps to Achieve Compliance

To meet the 2025 requirements, organizations must implement comprehensive controls and monitoring for third-party scripts:

- Inventory All Scripts:

- Document each third-party script’s purpose, source, and justification.

- Regularly update the inventory to reflect changes in the environment.

- Enforce Script Integrity:

- Use tools like Content Security Policies (CSP) to limit which scripts can run.

- Validate scripts using checksum hashing or digital signatures.

- Adopt Real-Time Monitoring:

- Invest in monitoring solutions that detect unauthorized changes to HTTP headers and scripts.

- Automate alerts to enable immediate responses to detected issues.

- Engage with Vendors:

- Work with third-party providers to ensure they follow secure development practices.

- Establish protocols for notifying you about script updates or vulnerabilities.

The Business Case for Compliance

Beyond meeting PCI DSS requirements, these measures provide broader benefits:

- Reduced Risk: Real-time monitoring and controls help prevent data breaches.

- Audit Readiness: Organized script inventories and monitoring logs simplify compliance audits.

- Customer Confidence: Securing payment systems builds trust and loyalty.

The March 2025 deadline is an opportunity for merchants to close gaps in their security strategy. Start now to ensure a seamless transition:

- Conduct a gap assessment to evaluate your current script security.

- Test and deploy monitoring tools.

- Train teams on the new compliance requirements.

The focus on third-party scripts represents a critical step in protecting payment data from evolving threats. By acting early, organizations can meet compliance goals while enhancing their security posture.