PCI Compliance Scanning

Your Path to PCI DSS 4.0.1 Compliance—Profitable, Secure, and Effortless

If you’re a merchant or a reseller, Clone Systems makes PCI DSS 4.0.1 compliance simple, secure, and profitable. Our comprehensive solutions empower businesses of all sizes to meet compliance standards while opening the door to growth opportunities.

PCI Compliance Scanning

Your Path to PCI DSS 4.0.1 Compliance—Profitable, Secure, and Effortless

If you’re a merchant or a reseller, Clone Systems makes PCI DSS 4.0.1 compliance simple, secure, and profitable. Our comprehensive solutions empower businesses of all sizes to meet compliance standards while opening the door to growth opportunities.

Customers Around the World

Key Benefits of Clone Systems’ PCI DSS 4.0.1 Solutions:

For Merchants:

For Resellers:

Protect your cardholder data

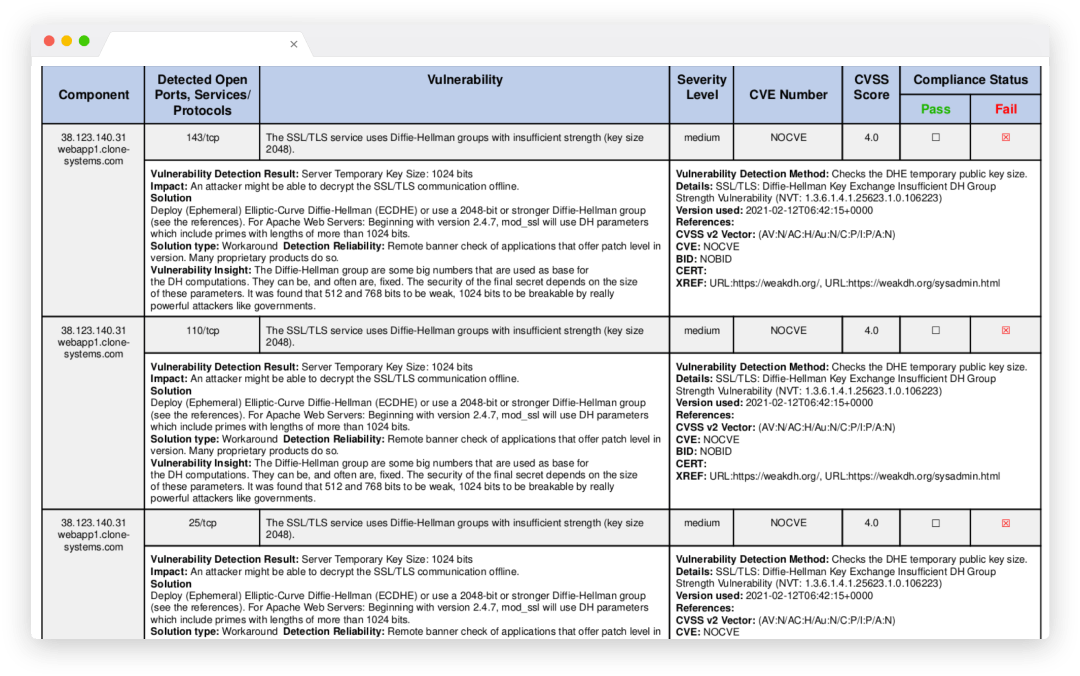

Minimize Your Risk

PCI Scanning minimizes the risk of compromise for cardholder data and the potential impact on your organization. Get detailed remediation steps for protecting against identified vulnerabilities detected during your PCI security scan. Make unlimited re-scans on your network to assess steps taken to fix vulnerabilities. Threat intelligence and signatures are consistently updated from multiple security sources to protect against emerging threats and vulnerabilities.

Protect your cardholder data

Minimize Your Risk

PCI Scanning minimizes the risk of compromise for cardholder data and the potential impact on your organization. Get detailed remediation steps for protecting against identified vulnerabilities detected during your PCI security scan. Make unlimited re-scans on your network to assess steps taken to fix vulnerabilities. Threat intelligence and signatures are consistently updated from multiple security sources to protect against emerging threats and vulnerabilities.

PCI dss compliance

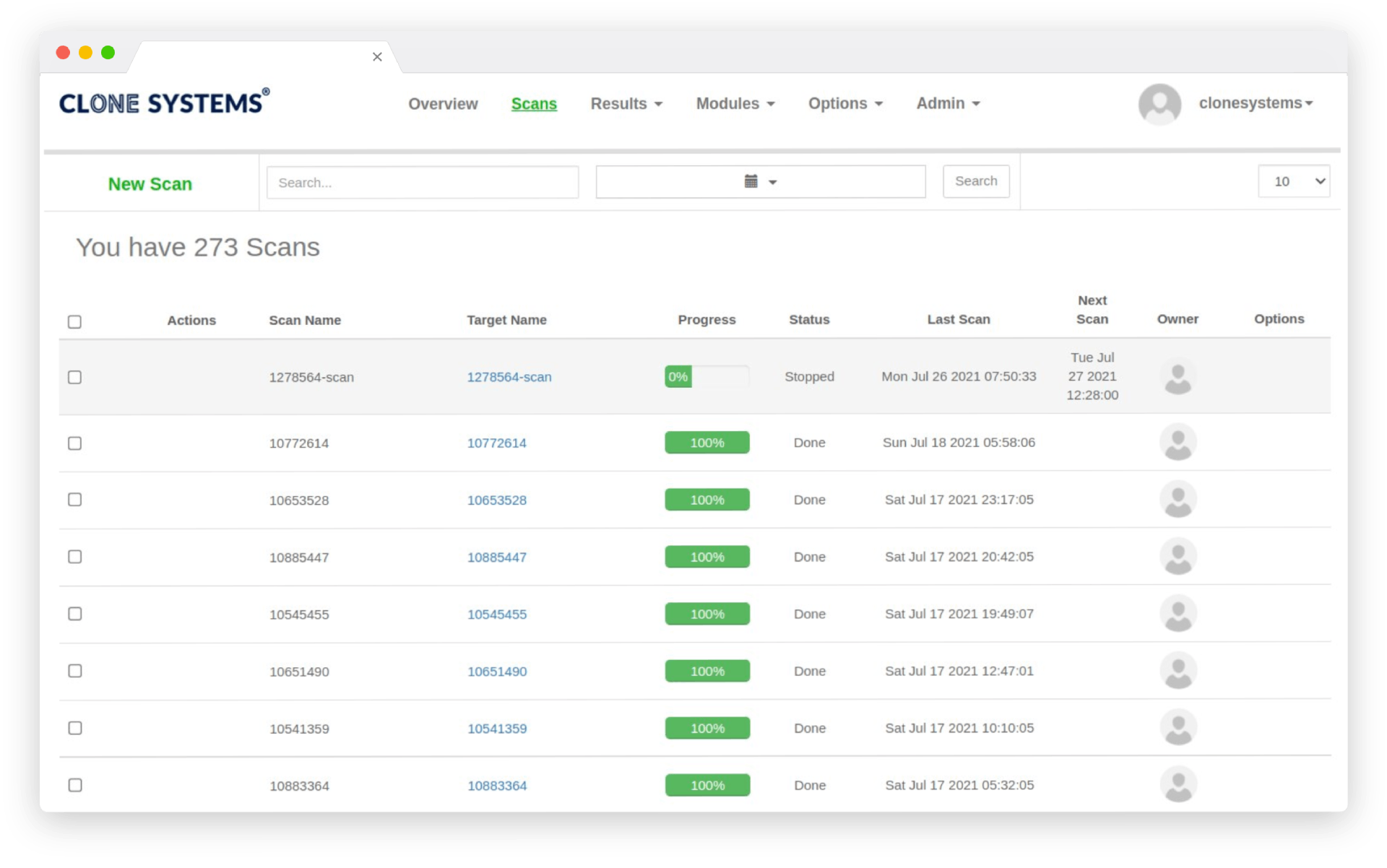

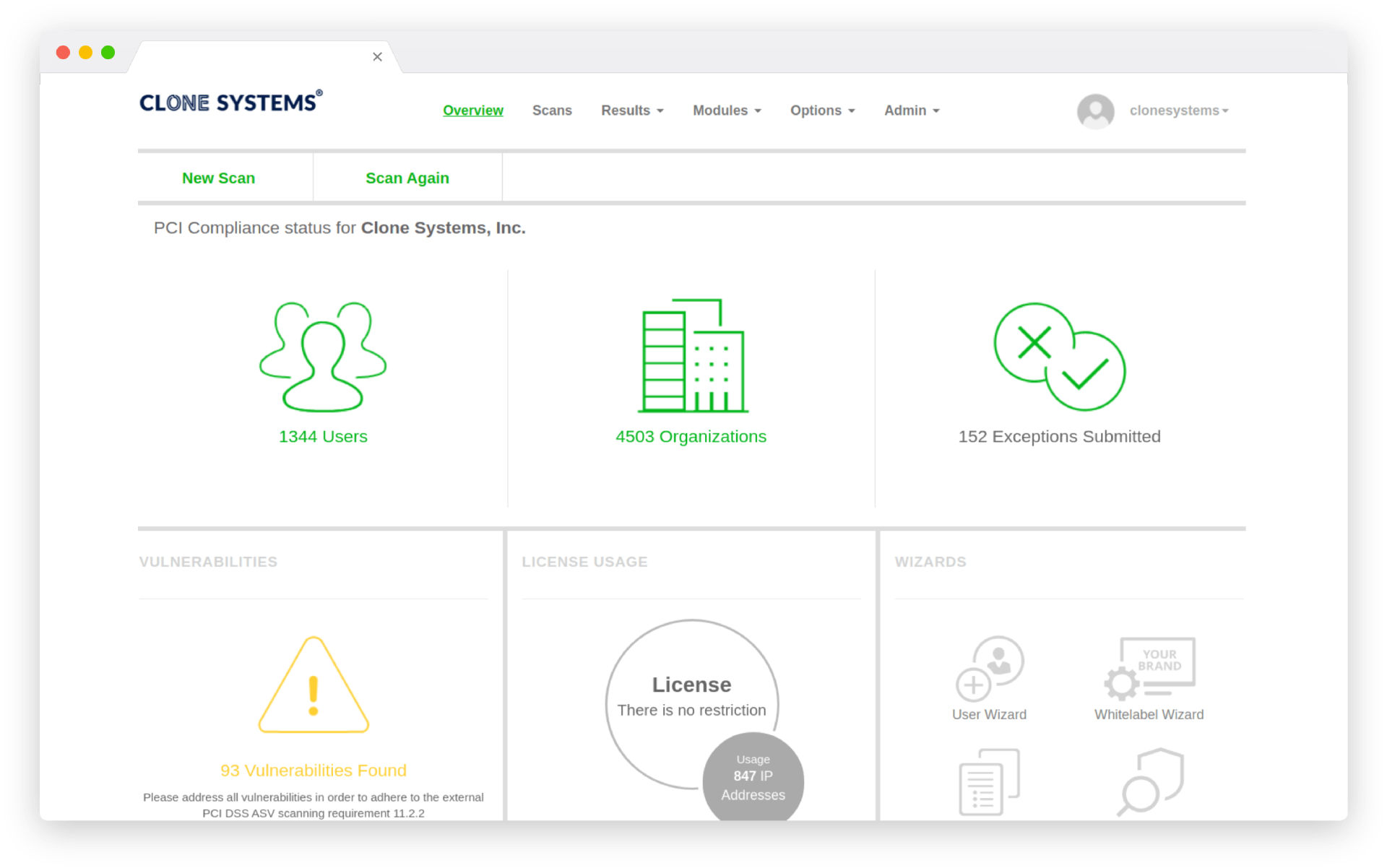

Leverage a Robust PCI DSS Solution

Leverage a robust PCI data security scanning solution from an Approved Scanning Vendor (ASV) that meets all the PCI Security Standards Council Requirements. The easy-to-use self-managed web-based scanning portal enables you to maintain PCI compliance by scheduling and running scans every 90 days or as often as you want. Analyze your solutions that store, process, or transmit cardholder data for threats and vulnerabilities that could expose sensitive data.

PCI dss compliance

Leverage a Robust PCI DSS Solution

Leverage a robust PCI data security scanning solution from an Approved Scanning Vendor (ASV) that meets all the PCI Security Standards Council Requirements. The easy-to-use self-managed web-based scanning portal enables you to maintain PCI compliance by scheduling and running scans every 90 days or as often as you want. Analyze your solutions that store, process, or transmit cardholder data for threats and vulnerabilities that could expose sensitive data.

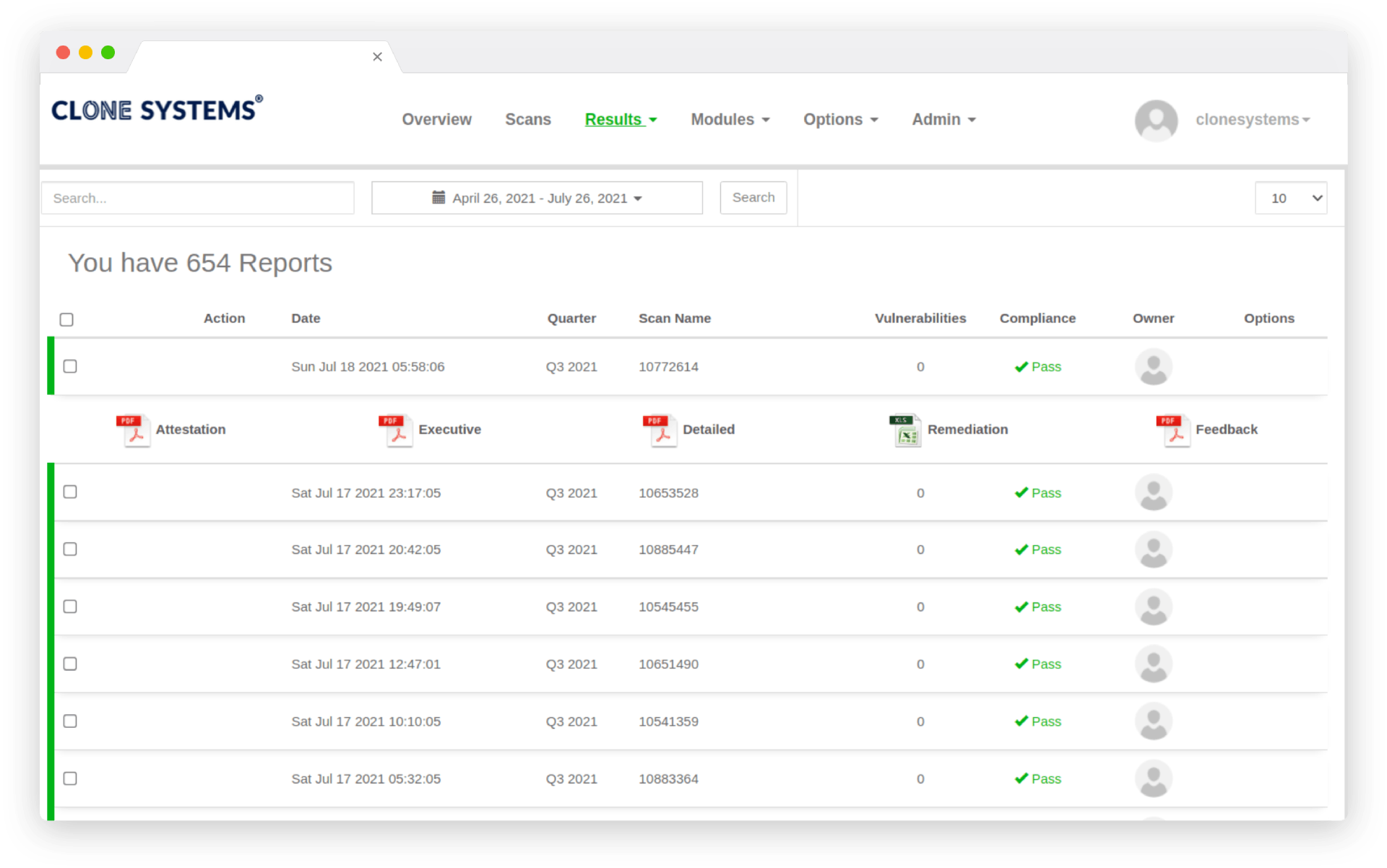

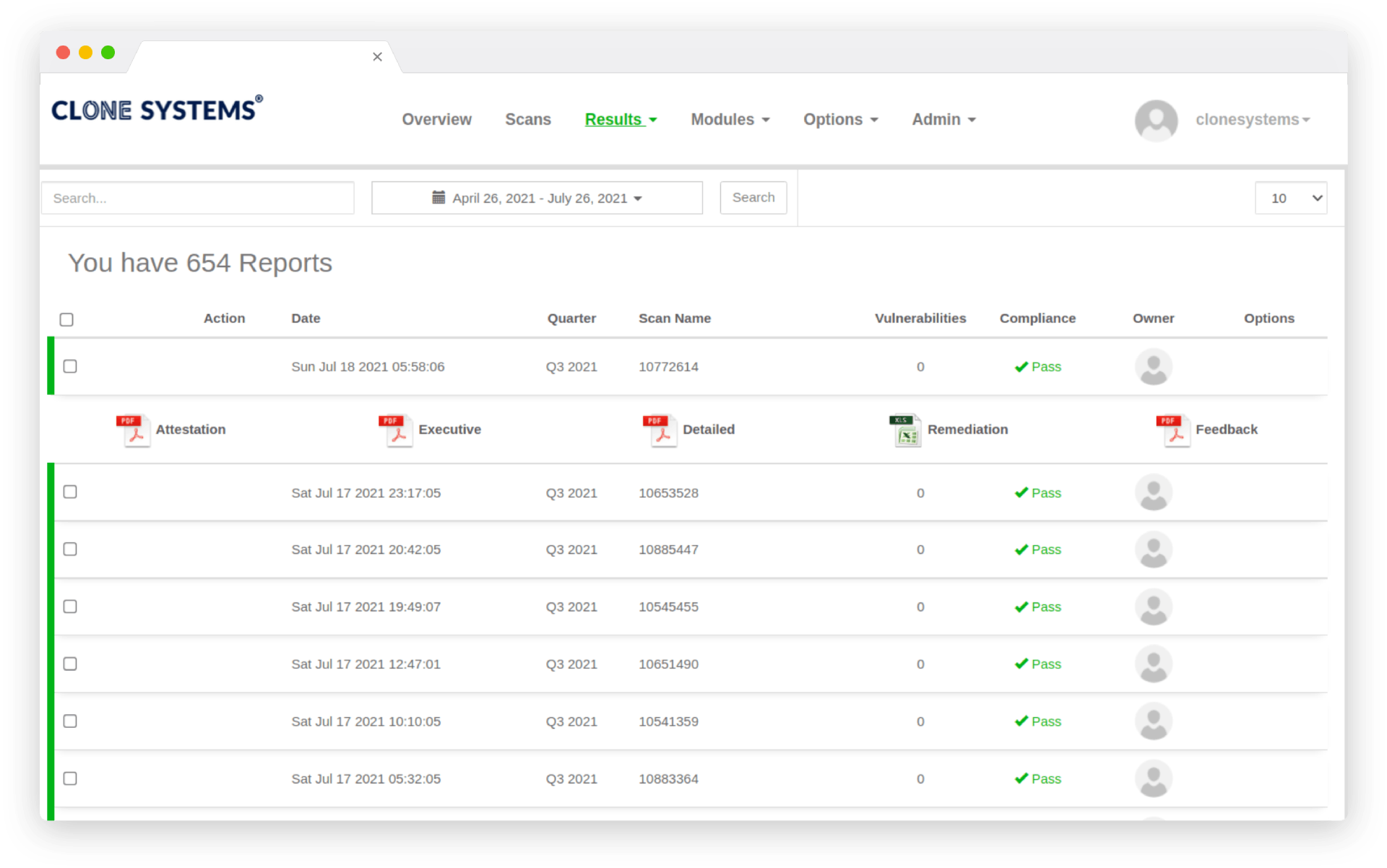

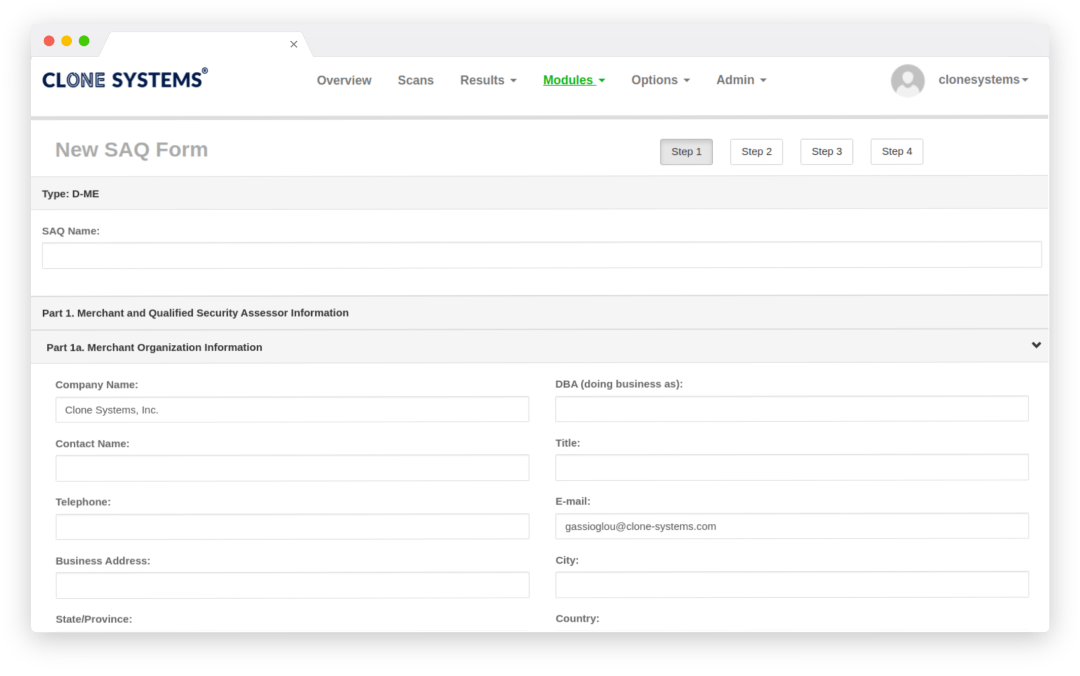

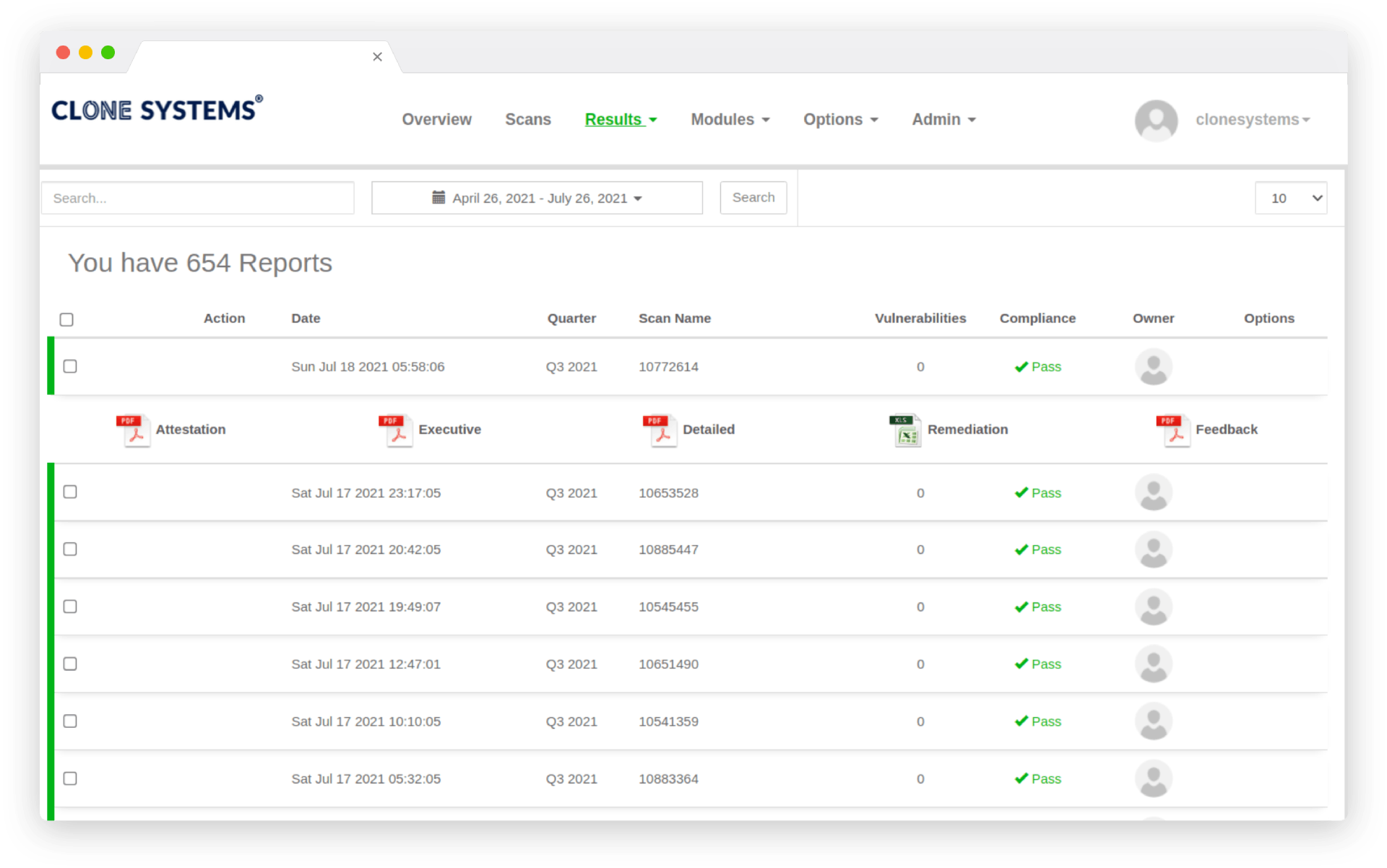

pci compliance reporting

Fulfill PCI Reporting Requirements

Fulfill PCI compliance reporting requirements for the acquiring banks, card brands, or other entities you do business with. Get Executive, Detailed, and Attestation PCI reports with ASV certification numbers to address your assessment and compliance reporting requirements. Access to the Online Self-Assessment Questionnaire (SAQ) for all the different SAQ types to assist you with reporting the results of your PCI SSC self-assessment.

pci compliance reporting

Fulfill PCI Compliance Reporting Requirements

Fulfill PCI compliance reporting requirements for the acquiring banks, card brands, or other entities you do business with. Get Executive, Detailed, and Attestation PCI reports with ASV certification numbers to address your assessment and compliance reporting requirements. Access to the Online Self-Assessment Questionnaire (SAQ) for all the different SAQ types to assist you with reporting the results of your PCI SSC self-assessment.

45M+

Vulnerability Checks

Performed Daily

7M+

Vulnerabilities

Uncovered Daily

21K+

Remediations

Performed Weekly

400+

New Signatures

Added Monthly

Minimize Your Risk

PCI Scanning minimizes the risk of compromise for cardholder data and the potential impact on your organization.

Minimize Your Risk

PCI Scanning minimizes the risk of compromise for cardholder data and the potential impact on your organization.

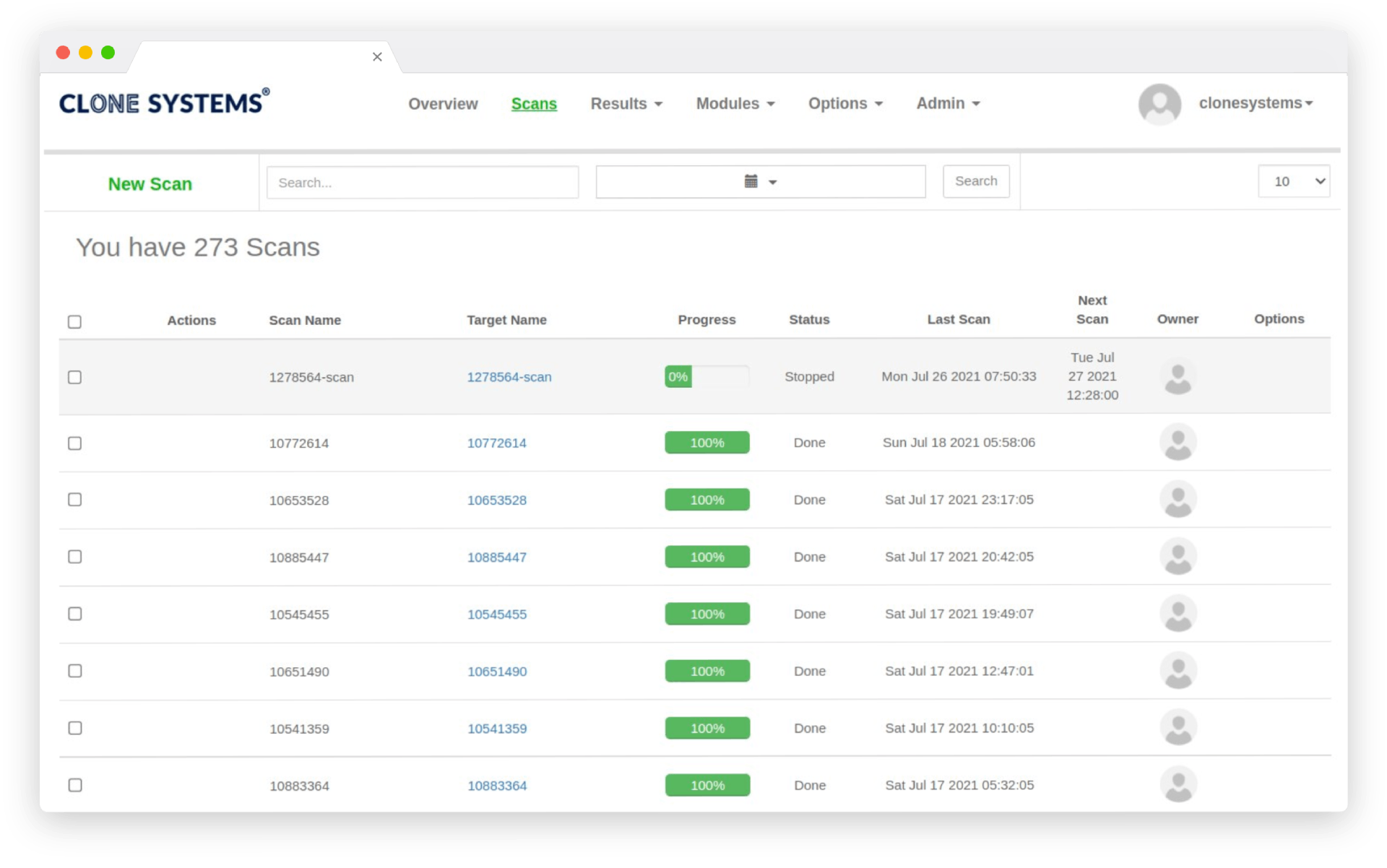

Easy to use self-managed web-based scanning portal

Re-scans on your targets and network

Executive, Detailed and Attestation PCI reports

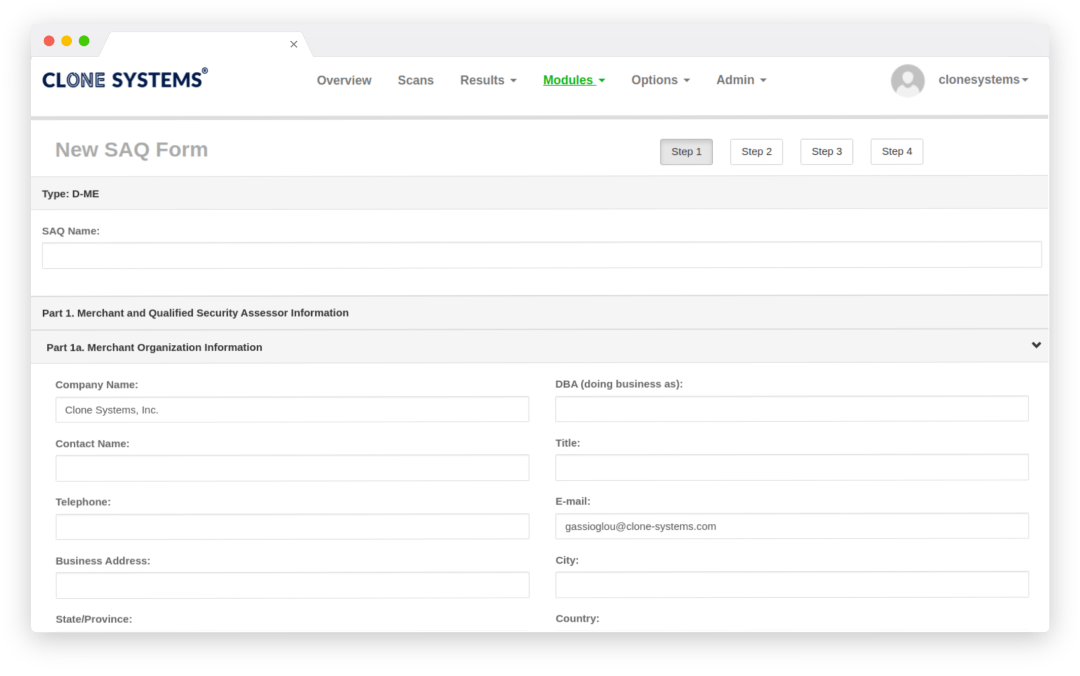

Online Self-Assessment Questionnaire (SAQ)

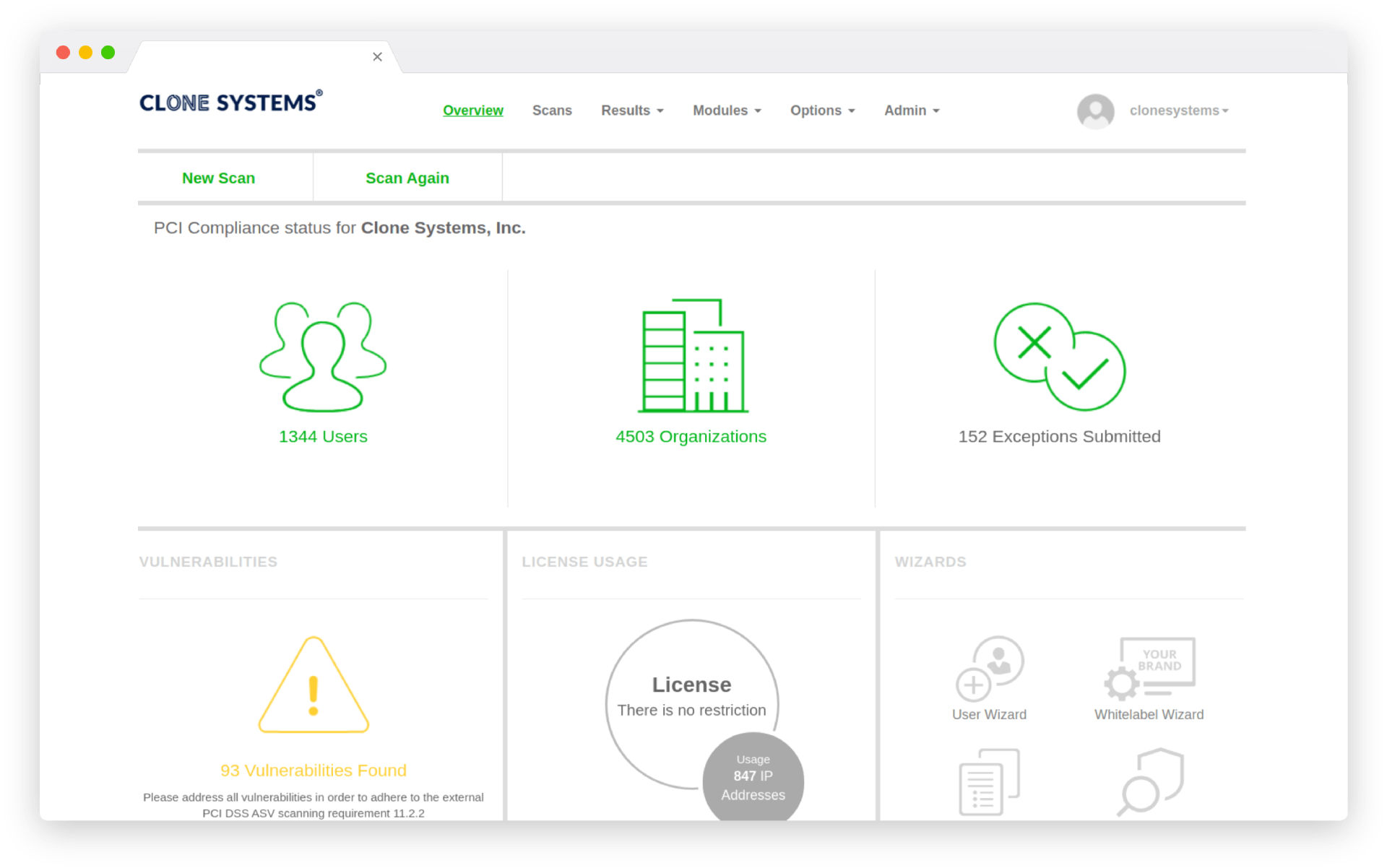

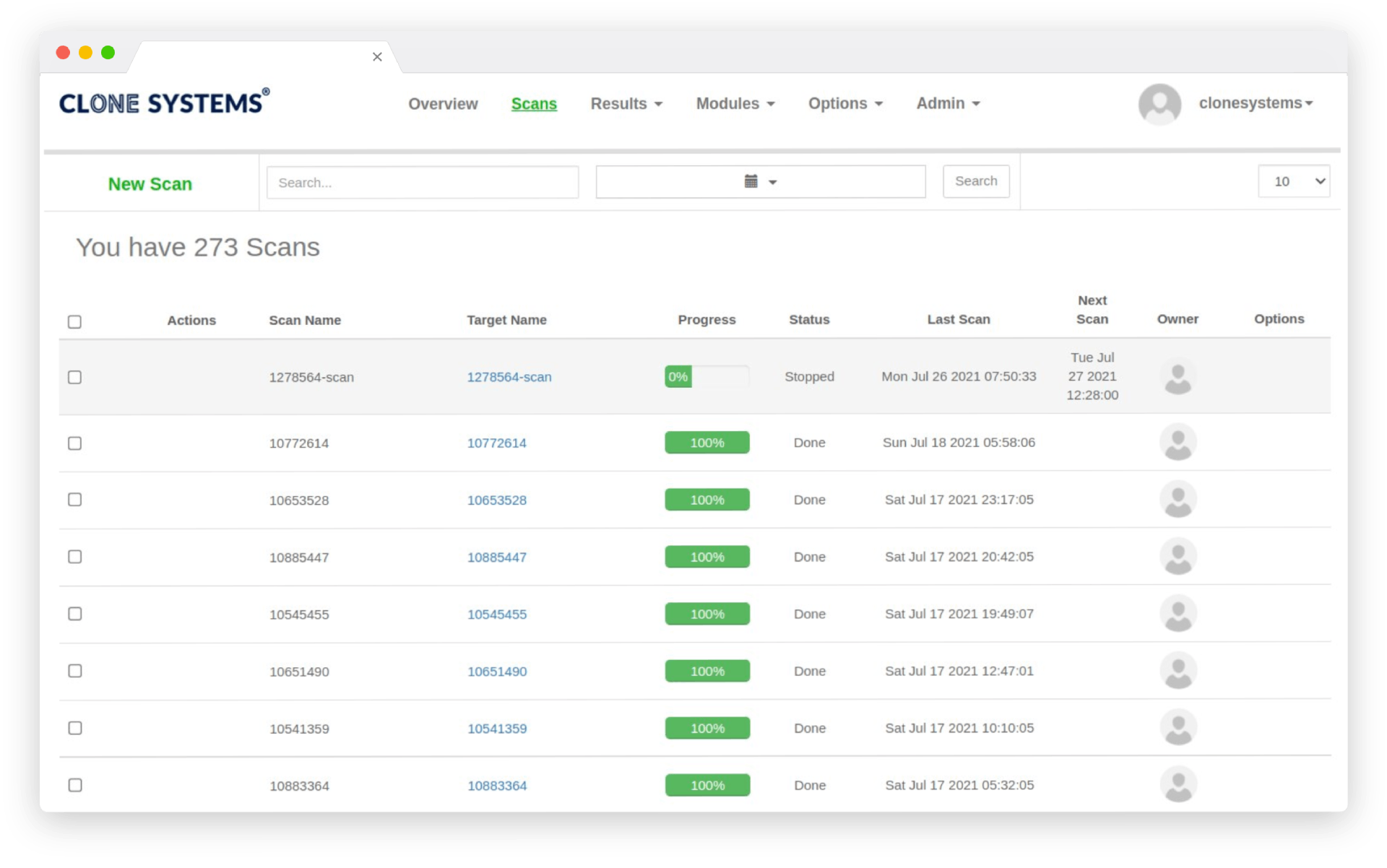

How PCI Compliance Scanning works

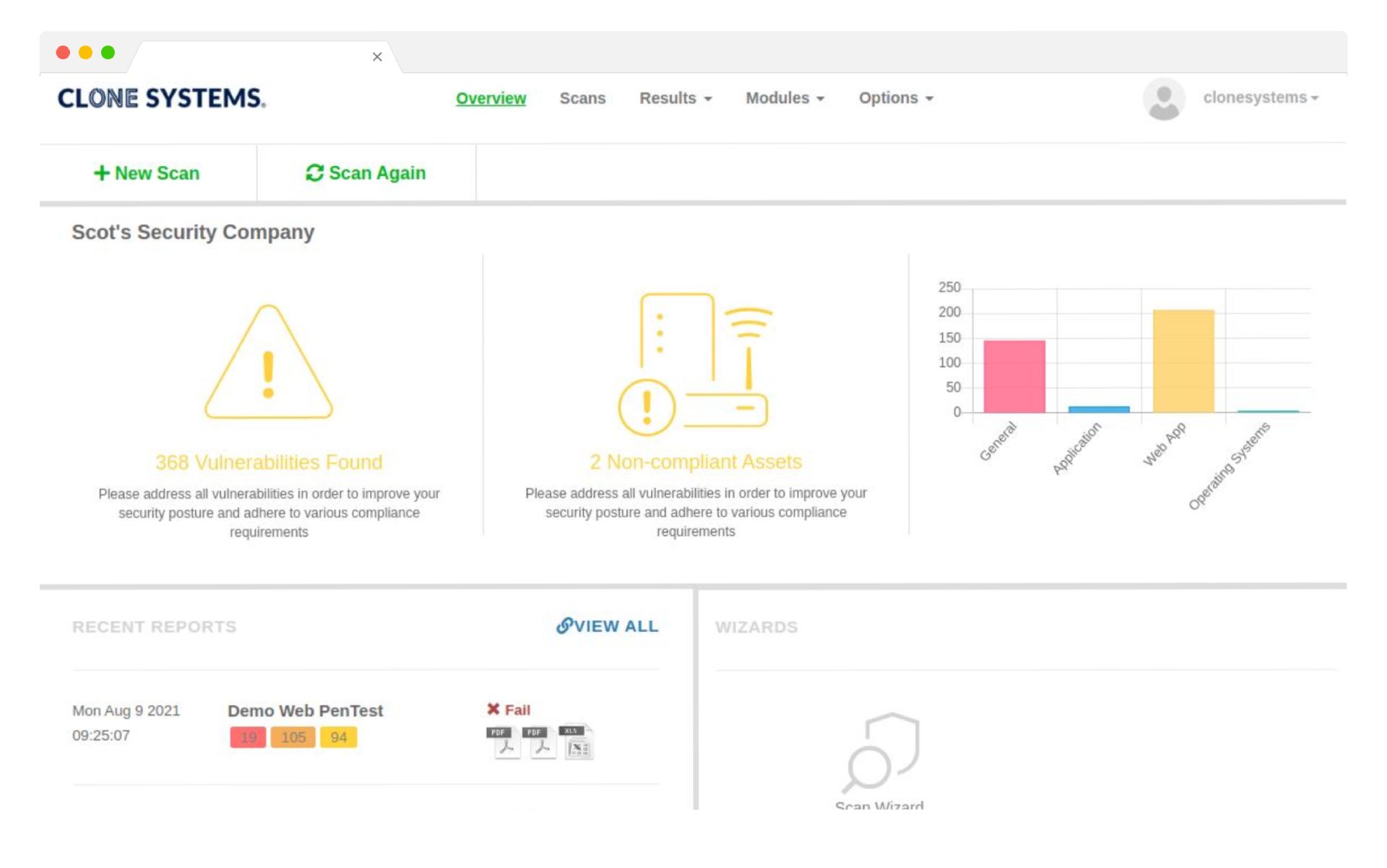

Payment Card Industry (PCI) compliance scans are conducted through a self-managed web-based PCI Compliance Scanning portal which is consistently updated with the latest threat intelligence and certified annually to meet all the PCI Security Standards Council requirements.

Using a simple interface or intuitive wizard, you can configure, schedule, and run scans for the hosts that store, process, or transmit cardholder data. If vulnerabilities appear, you are presented with details and remediation steps to address them. Your team can then work to resolve the findings and then rescan the hosts to confirm that any identified vulnerabilities have been fixed.

Once your hosts that process credit card information are secured from all known high and medium vulnerabilities the Executive, Detailed and Attestation PCI compliance reports will be certified with a passing status and can be delivered to your acquiring banks, card brands, or other requesting entities you do business with.

The portal provides a Self-Assessment Questionnaire (SAQ) wizard that can be used to help you identify the SAQ type that aligns with your business requirements so you can complete an online version of the SAQ and report the results of your PCI Data Security Standards (DSS) self-assessment.

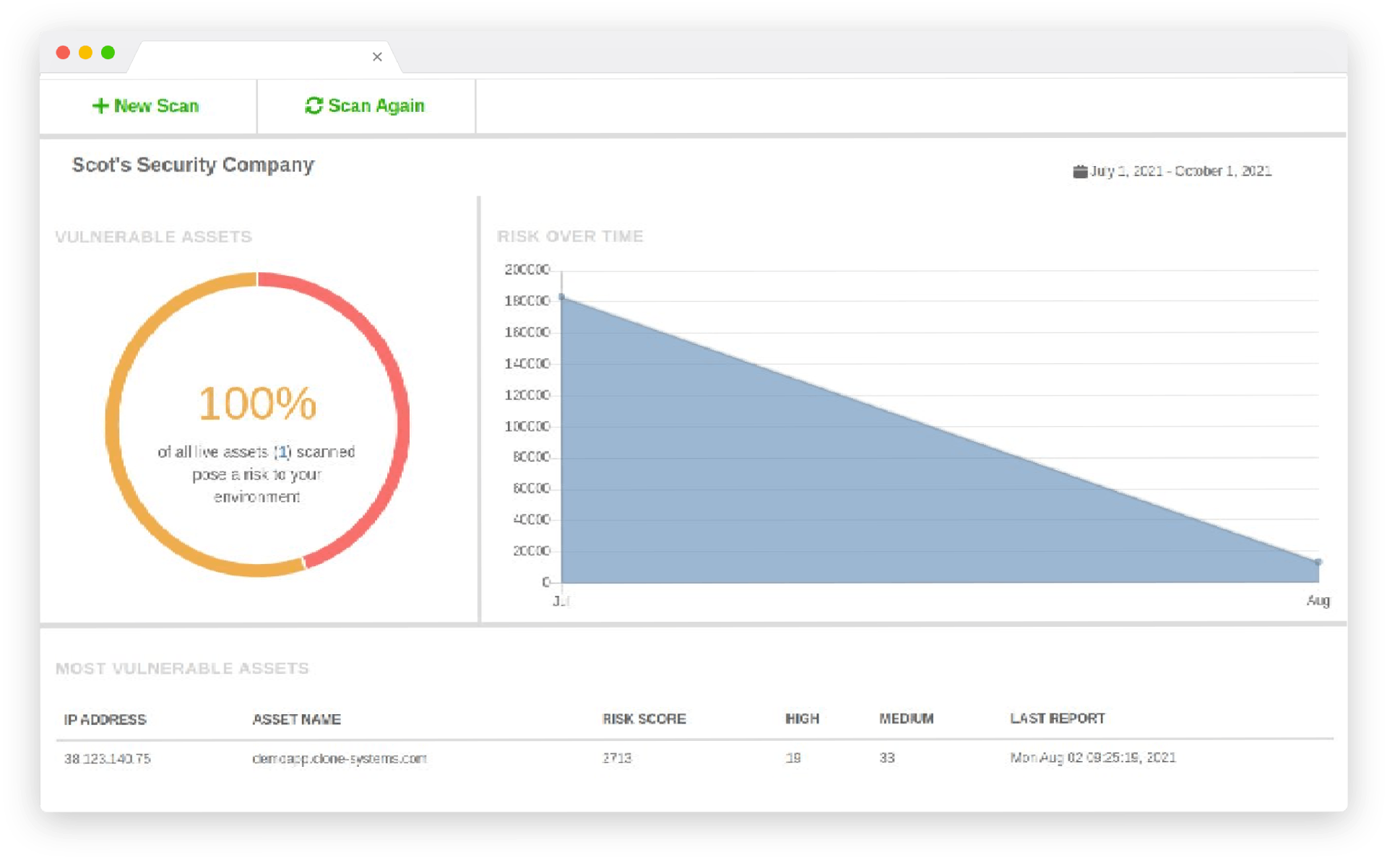

Our PCI Scanning Portal

CLONE SYSTEMS PCI SURVIVAL GUIDE

For smaller companies and merchants, the lack of clarity on some of the more technical aspects of PCI DSS 4.0 may lead to some speed bumps. Download Clone Systems survival guide as a useful resource.